Fighter planes, battle tanks, artillery and drones dominate the international arms trade. And as a recent report by the Stockholm International Peace Research Institute (SIPRI) shows, more and more of these weapons are being procured by European countries.

The latest SIPRI report states that although the global transfer of military equipment decreased by 5.1 percent in the period from 2018 to 2022 compared to 2013 to 2017, imports in Europe increased over the five years, with the last reporting year 2022 in particular showing a significant increase as a result of the war in Ukraine.

All in all, European countries imported 47% more weapons in the reporting period than in the same period from 2013 to 2017. If only the European NATO countries are considered, arms imports even increased by 65%. This trend is set to continue, because after the Russia’s major attack on Ukraine Europe’s NATO countries are in the process of significantly stepping up their defense efforts.

All in all, European countries imported 47% more weapons in the reporting period than in the same period from 2013 to 2017. If only the European NATO countries are considered, arms imports even increased by 65%. This trend is set to continue, because after the Russia’s major attack on Ukraine Europe’s NATO countries are in the process of significantly stepping up their defense efforts.

At the same time, deliveries of weapons and ammunition to Ukraine are causing stocks in Western arsenals to dwindle – in Europe and even in the USA. Both there and in Europe, people are now starting to re-supply and rebuild for their own needs. The arms aid for Ukraine is also reflected in the SIPRI report: the Eastern European country is the 14th largest arms importer in the entire period from 2018 to 2022, but if we only look at 2022 – the year of the Russian invasion – Ukraine is even in third place in the ranking of the largest importers.

German companies benefit

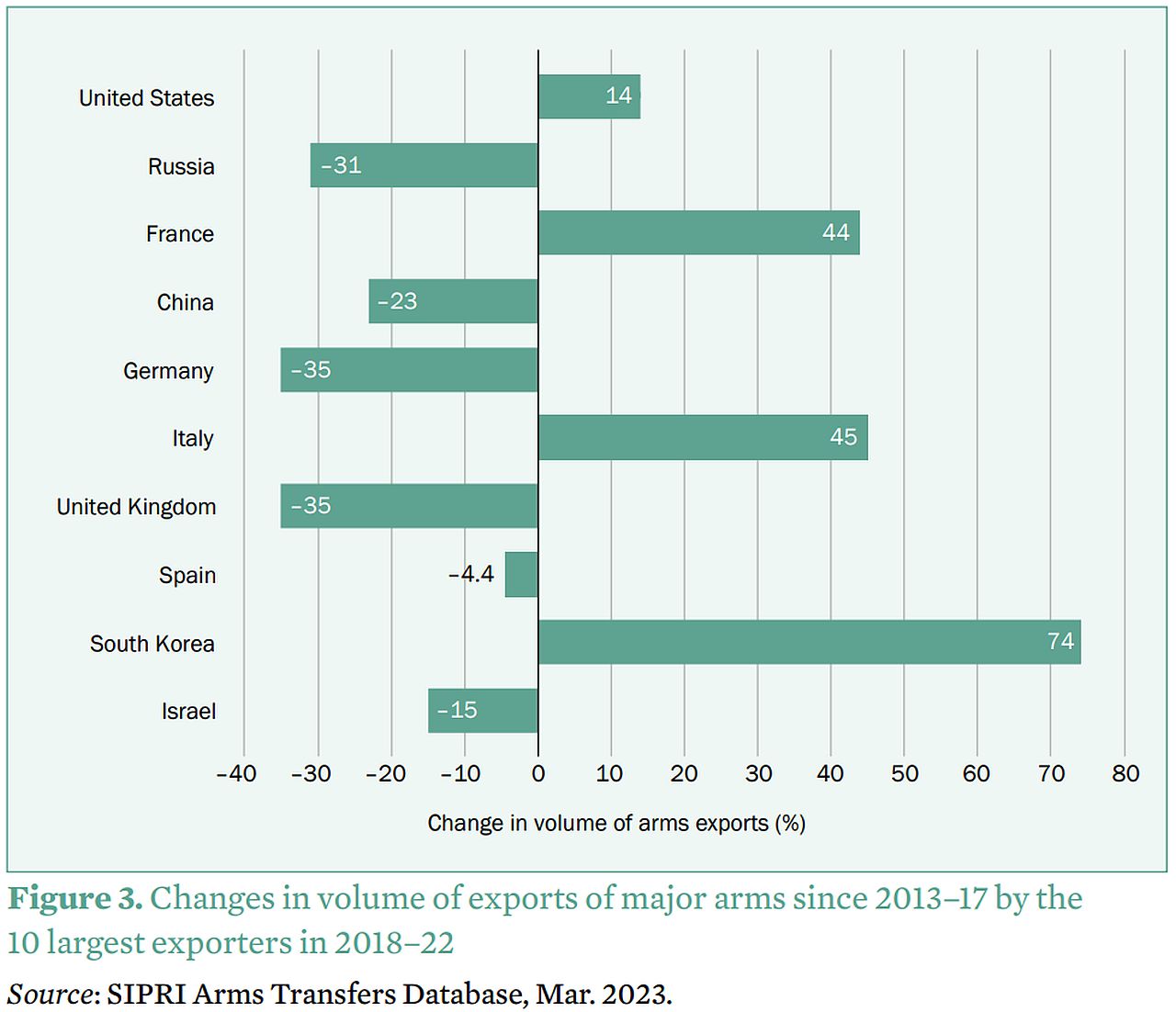

American and European arms manufacturers in particular, including German companies, benefited from the increased investment in Europe. Between 2018 and 2022, Germany was the fifth-largest supplier of weapons with a global market share of 4.2 percent. However, by the start of the war in Ukraine, German exports had fallen by 35% compared to the previous five years. Now the trend is pointing in exactly the opposite direction: Rheinmetall for example, is building a new ammunition factory in Lower Saxony to cope with the increased demand. Around 300,000 rounds are to be produced there by the summer for the obsolete Gepard anti-aircraft tank that Germany has supplied to Ukraine. This step became necessary because neutral Switzerland could not bring itself to approve ammunition exports from its Oerlikon group (including to third parties). And in Saxony, a powder production facility costing up to 800 million euros is under discussion. https://militaeraktuell.at/rheinmetall-repariert-waffen-der-ukraine-in-rumaenien/ Rheinmetall is also planning to build a factory for its ultra-modern Panther main battle tank on a greenfield site in Ukraine. 400 Panthers are to roll off the production line there every year, protected by the (company’s) own Mantis air defense system. The Düsseldorf-based arms manufacturer’s share price has more than doubled since the start of the war, and at the end of February the company was even included in the DAX, Germany’s leading stock market index. The Munich-based company Kraus-Maffei Wegmann (KMW) also builds war material that is used in Ukraine – such as the much-discussed Leopard 2 main battle tank or the self-propelled artillery Panzerhaubitze 2000. In February, Munich announced that production could be ramped up, but that orders were (still) being awaited.

Austria’s neighbor Italy – as the supplier of the 36 36 Leonardo helicopters recently ordered by the Austrian Armed Forces (and possibly also jet trainers in the future) – ranks sixth in the global ranking with 3.8% and takes fourth place for imports in the Middle East, with a total of 67% of Italian exports going to the region, 45% more from 2018 to 2022 than in the period up to 2017. Main supplier USA, also due to F-35

Austria’s neighbor Italy – as the supplier of the 36 36 Leonardo helicopters recently ordered by the Austrian Armed Forces (and possibly also jet trainers in the future) – ranks sixth in the global ranking with 3.8% and takes fourth place for imports in the Middle East, with a total of 67% of Italian exports going to the region, 45% more from 2018 to 2022 than in the period up to 2017. Main supplier USA, also due to F-35

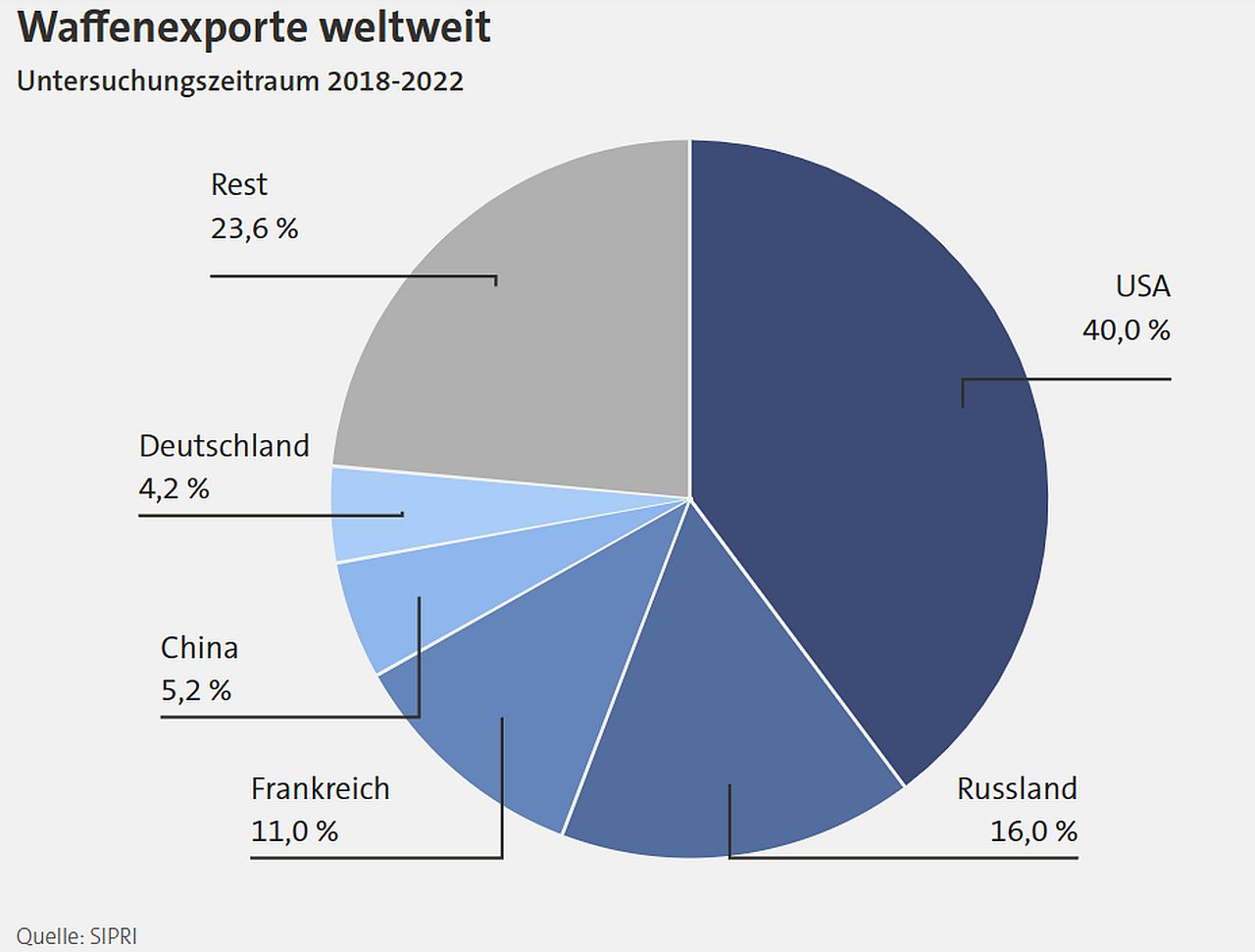

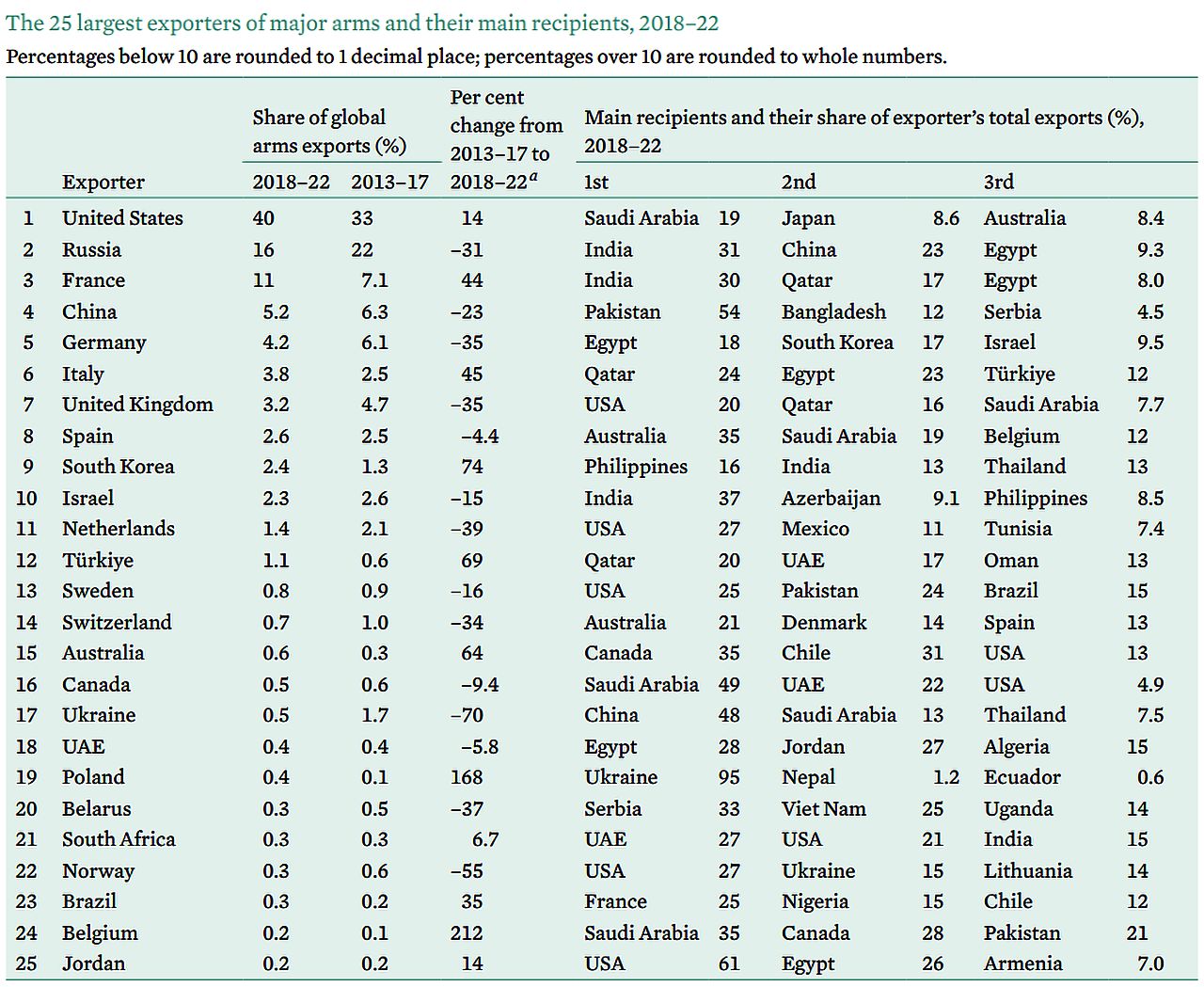

The USA is the beneficiary of the “new Cold War”, benefiting the most from the European arms build-up and further expanding its position as the largest arms exporter. However, Washington also remains the world’s largest arms supplier: 23% of its total arms exports went to European countries between 2018 and 2022, eleven percent more than before. Of the European NATO states, the United Kingdom, the Netherlands and Norway were the main importers from the USA. It is mostly expensive high-tech weapons that NATO allies receive – such as the F-35 stealth fighter bomber developed by the USA in cooperation with other partners. In addition to the USA, the modern jet is also used by the UK, the Netherlands, Norway and Italy. Poland has ordered 32 of them, Germany is procuring 35 of these jets. The shares of the US defense contractor Lockheed Martinwhich manufactures (among other things) the F-35, rose by 37% last year, while shares in the US company Raytheon Technologies with its various rockets and missiles rose by almost 17%. Both companies recently also received orders for the production of guided weapons for Ukraine and the emptying US arsenals.  Global trends

Global trends

The USA supplied the most weapons to Saudi Arabia (19 percent of total US arms exports), Japan (8.6 percent), Australia (8.4 percent) and South Korea (6.5 percent). In contrast, deliveries of US war equipment to NATO partner Turkey fell drastically due to bilateral tensions. Turkey fell from 7th to 27th place among the largest recipients of US weapons, probably due to the exclusion of the F-35 because of the purchase of Russian air defense systems. A total of 23% of US arms exports went to countries in Europe between 2018 and 2022, compared to 11% in the previous four years. And while arms were being upgraded in Europe, the volume of arms transfers worldwide fell by 5.1% in the period from 2018 to 2022 compared to the same period from 2013 to 2017. Arms imports fell in Africa (minus 40 percent), America (minus 21 percent), Asia (minus 7.5 percent) and the Middle East (minus 8.8 percent). In contrast, there were increases in arms imports in East Asia due to geopolitical tensions with China and North Korea. Traditional alliances were reaffirmed here, for example China – unsurprisingly – accounted for 77% of Pakistan’s imports. On the other hand, US allies South Korea (+61%) and Japan (+171%) recorded the largest increases, with the USA of course being the main supplier.

Their share of global arms exports rose from 33% to 40% in the period from 2018 to 2022. Meanwhile, exports from Russia, the second largest arms exporting country, fell from 22% to 16% of global exports. The reason for this is that Russia is prioritizing the supply of its own armed forces. In addition, the reputation of Russian military technology has clearly suffered in light of the results in Ukraine. Due to the sanctions against Russia and pressure from the USA and its allies, demand from other countries for Russian weapons is also likely to remain low, according to the report.

France third largest export country, India largest importer

France is the third largest exporter of war equipment, with an order for 80 Rafále jets for the Emirates, for example. order for 80 Rafále jets for the Emirates – increased its share of global arms exports from 7.1% to 11% between 2018 and 2022 compared to the previous five years. Incidentally, almost a third of the 44% increase in French arms exports – which mainly consisted of 36 Rafále jets – to India. Nevertheless, Delhi remains the largest recipient of Russian weapons and, with a current share of 13 percent, also the largest arms importer in the world, even though the volume of Russian exports to Delhi shrank by 37 percent. In contrast, Russian arms exports to China (up 39%, for example Su-35S) and Egypt (up 44%, for example MiG-29M and Ka-52) increased, making them Russia’s second and third largest recipients. Saudi Arabia and the small emirate of Qatar, which recently increased its arms imports – via three parallel aircraft purchases – by 311 percent (!), follow in second place in the global ranking of the largest arms importers. Australia and China are in fourth and fifth place in terms of arms imports.

Russia remains the main supplier to Africa

Russia is the main supplier of weapons to Africa: 40 percent of African arms imports came from Russia between 2018 and 2022, followed by the USA (16 percent), China (9.8 percent) and France (7.6 percent). According to the report, several arms exporting countries are competing for influence in sub-Saharan Africa: Russia overtook China in terms of arms deliveries between 2018 and 2022 and became the largest supplier in the sub-Saharan region. 21 percent of weapons to the countries came from Russia, 18 percent from China and 8.3 percent from France. Overall, arms imports from countries in sub-Saharan Africa fell by 23 percent, with Angola, Nigeria and Mali being the largest recipients. Since the end of the USSR, combat aircraft and helicopters have “traditionally” been the largest “single item” in the Russian arms export business, accounting for around 40 percent, with 328 units (mostly Flanker derivatives) sold worldwide between 1992 and 2022. By the end of 2022, however, only 84 of them were still on Russia’s books. https://militaeraktuell.at/versenkung-der-moskwa-so-war-es-wirklich/ 100 billion euros for the Bundeswehr

Following Russia’s invasion of Ukraine, Chancellor Olaf Scholz had pledged 100 billion euros for the Bundeswehr promised. According to the Ministry of Defence, none of this has been spent in the whole of 2022, but around a third has been planned: for transport helicopters, digitalization and the aforementioned F-35 jets. However, due to the interest on the special funds raised, increased prices and VAT, experts believe that only 50 to 70 billion euros of the 100 billion euros will be earmarked or available for war material after one year. With regard to these financial volumes, it should generally be noted that arms contracts are often “non-transparent” for reasons of military secrecy and competition. It is therefore often difficult for the SIPRI researchers led by Pieter and Simeon Wezeman to calculate the total value of the weapons traded. They estimate the annual global arms trade at around 93.8 billion euros; according to them, total military spending exceeded the two trillion US dollar (just under two billion euros) mark in 2021.